Asset allocation formula

Ally Brings Smart Easy Affordable Robotics to a Shrinking Labor Force. 30 Lower Production Cost.

Portfolio Optimization From Scratch By Kevin Mekulu The Startup Medium

Ad Get customized and devoted help at every stage of your financial journey.

. Or E Rc Rf Spσ Rc where Sp. So if youre 40 you should hold 60 of your. This is because the asset allocation in this type of portfolio is typically fairly well balanced between stocks and fixed income and cash.

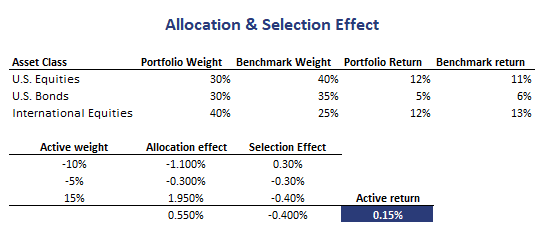

The asset allocation return is the result of deviations from the asset class portfolio weights of the benchmark. Contract With 500M Company. Medium risk tolerance age minus 10.

The security selection return results from deviations from benchmark weights. The common rule of asset allocation by age is that you should hold a percentage of stocks that is equal to 100 minus your age. We work directly with their investment team.

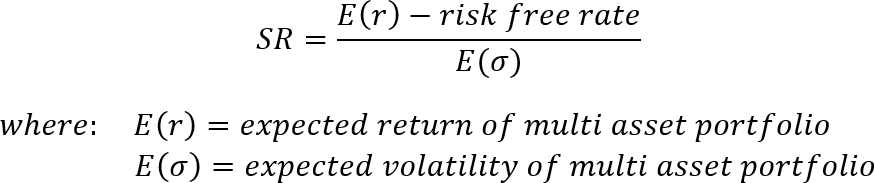

The slope of the line Sp is called the Sharpe ratio or reward-to-risk ratio. Ad Helping non-profits navigate their unique investment challenges for more than 40 years. Following asset allocation formula.

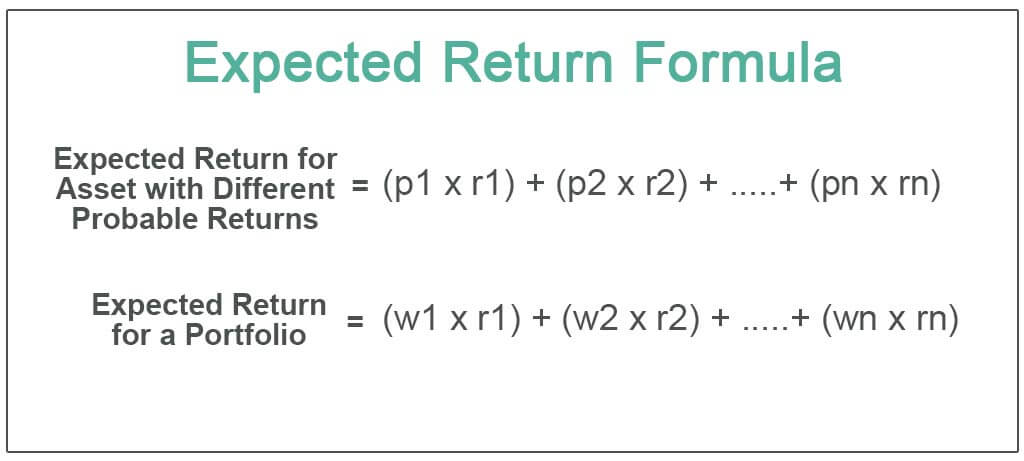

To make your allocation decisions easier financial professionals have devised some standard formulas for dividing up your portfolio based on. If the investor allocated 25 to the risk-free asset and 75 to the risky asset the portfolio expected return and risk calculations would be. The closing out of a profitable short position as the security moves toward a key level of support.

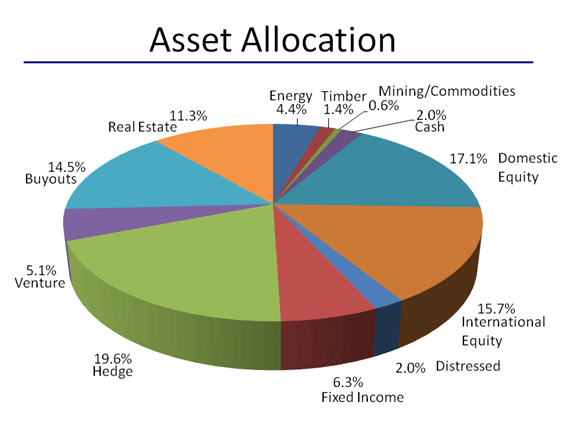

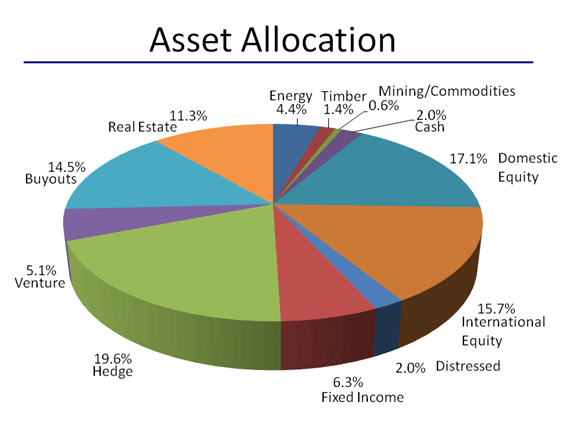

Asset allocation is the value added by under-weighting cash 10 30 1 benchmark return for cash and over-weighting equities 90 70 3 benchmark return for equities. Asset allocation is the primary determinant explains 936 of the variation of a portfolios return variability with security selection and market timing together active. Low risk tolerance age in bonds.

Ad Learn How Vanguard Tools For Advisors Can Help You Forecast Client Portfolio Performance. The line E Rc Rf Spσ Rc is the capital allocation line CAL. The first step is the asset allocation decision which can refer to both the process and the result of determining long-term strategic exposures to the available asset classes or risk factors.

Our clients get the best of both worlds. As a simplistic example Ill use. ER of portfolio 3 x 25 10.

High risk tolerance age minus 20. For each fund multiply the percentage that the fund represents in your portfolio by the percentage of the fund thats. Our Tools Provide Reliable Unbiased Data To Help You Analyze And Optimize Portfolios.

As a security moves closer to a level of support the. Holistic approaches to wealth management including financial planning and goal setting. The quick way to calculate your bond allocation.

Allocation Effect Selection Effect 524 324 200 050 250 As we noted the investment decisions generated a positive excess return of 200 basis points bps relative to the. This portfolio might have an allocation in. Cover On Approach.

Asset allocation is the implementation of an investment strategy that attempts to balance risk versus reward by adjusting the percentage of each asset in an investment portfolio according.

Solactive Diversification The Power Of Bonds

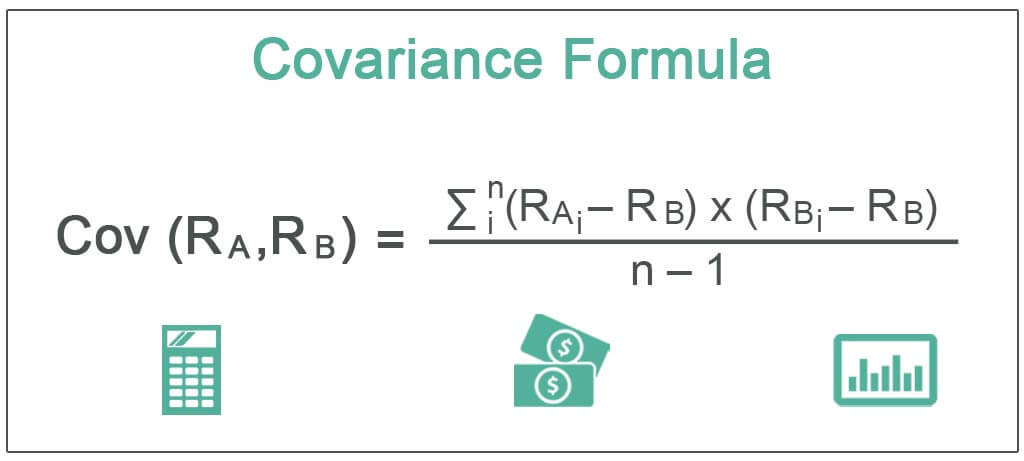

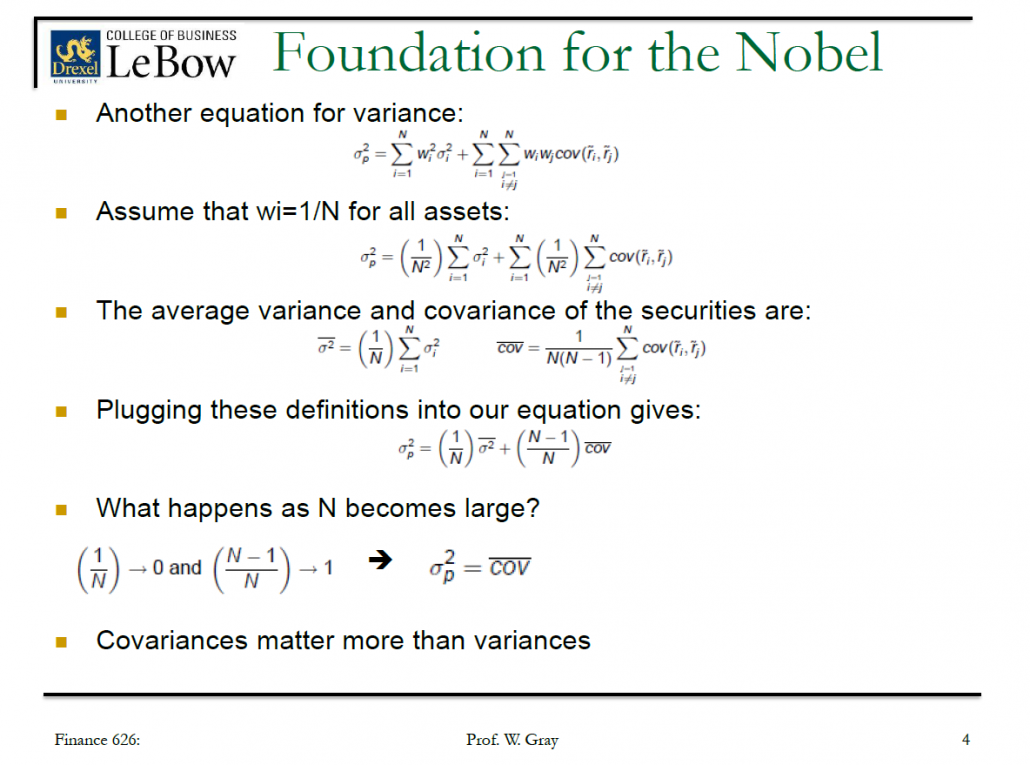

Covariance Meaning Formula How To Calculate

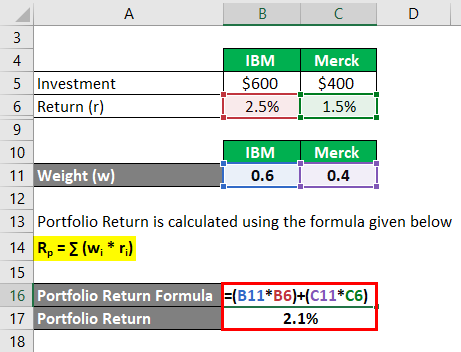

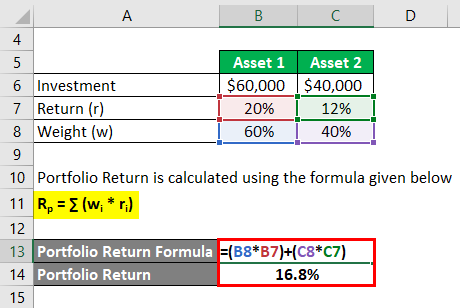

Portfolio Return Formula Calculator Examples With Excel Template

Asset Management Lecture 15 Outline For Today Performance Attribution Ppt Download

Solactive Diversification The Power Of Bonds

Lower Risk By Rethinking Asset Allocation Seeking Alpha

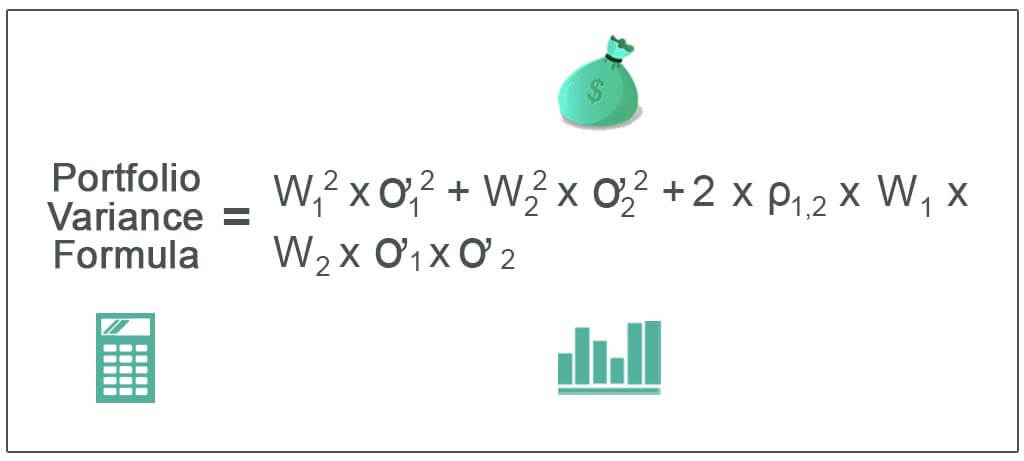

Portfolio Variance Formula Example How To Calculate Portfolio Variance

Expected Return Formula Calculate Portfolio Expected Return Example

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

Allocation Effect Implementation In Excel

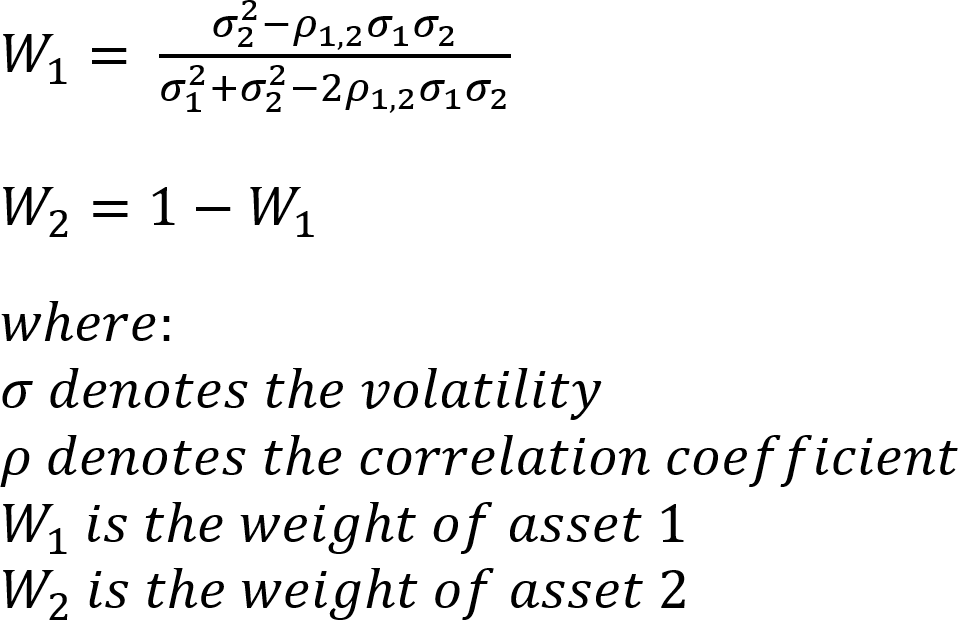

Optimization Formula For Optimal Portfolio Of 2 Assets When No Shorting Allowed Quantitative Finance Stack Exchange

Portfolio Return Formula Calculator Examples With Excel Template

Standard Deviation And Variance Of A Portfolio Finance Train

Mean Variance Portfolio Allocation Finance

Tactical Asset Allocation Beware Of Geeks Bearing Formulas

Portfolio Return Formula Calculator Examples With Excel Template